Alipay Cross-Border Payment: Revolutionizing Global Transactions

In today's interconnected world, cross-border payments have become an essential part of international trade and commerce. Alipay, the leading digital payment platform in Asia, has emerged as a game-changer in this space, offering seamless and secure payment solutions for businesses and consumers alike. As global commerce continues to expand, understanding how Alipay facilitates cross-border transactions is crucial for anyone involved in international business.

Alipay has built a reputation as a reliable and innovative payment provider. With its robust infrastructure and partnerships with financial institutions worldwide, Alipay has made it easier than ever for businesses to reach new markets and for consumers to shop globally. This platform's impact on global payments cannot be overstated, as it continues to drive growth in international trade.

In this comprehensive article, we will explore the various aspects of Alipay cross-border payment solutions, including their features, benefits, and challenges. We'll also provide insights into how businesses can leverage Alipay's capabilities to expand their global reach and enhance customer experience. Whether you're a small business owner or a large corporation, understanding Alipay's role in global payments can significantly impact your business success.

- Unraveling Johnny Cash The Story Of A Country Legend

- Loretta Lynns Granddaughter Singing A New Star On The Rise

- Spicy Rigatoni Vodka Cheesecake Factory A Flavorful Journey

- The Unrivaled Legacy Of The Worlds Best Rapper

- Uncovering The Origins Of Jelly Roll A Journey Through Music And Life

Table of Contents

- Introduction to Alipay Cross-Border Payment

- The History and Evolution of Alipay

- Key Features of Alipay Cross-Border Payments

- Benefits of Using Alipay for Cross-Border Transactions

- Challenges in Cross-Border Payments

- Statistical Insights into Alipay's Global Impact

- Security Measures in Alipay Cross-Border Payments

- Strategic Partnerships and Collaborations

- The Future of Alipay in Global Payments

- Conclusion and Call to Action

Introduction to Alipay Cross-Border Payment

Alipay has been at the forefront of digital payment innovation since its inception in 2004. As part of the Alibaba Group, Alipay has grown to become one of the largest payment platforms in the world, with over 1.2 billion active users globally. The platform's cross-border payment capabilities have transformed the way businesses and consumers engage in international transactions.

How Alipay Facilitates Global Transactions

Alipay's cross-border payment system leverages advanced technology and partnerships to ensure secure and efficient transactions. By integrating with local payment systems and financial institutions, Alipay provides a seamless experience for both merchants and customers. Some of the key functionalities include currency conversion, real-time transaction processing, and fraud prevention.

For businesses looking to expand their reach into international markets, Alipay offers a comprehensive suite of tools and services that simplify the complexities of global payments. From managing multiple currencies to complying with local regulations, Alipay ensures that businesses can focus on growth while leaving the payment infrastructure to the experts.

- Auntie Annes Sweet Glaze Recipe The Ultimate Guide To Perfect Pretzel Toppings

- Mastering The Mid High Drop Fade A Comprehensive Guide

- Exploring Bob Marleys Net Worth A Legacy Beyond Wealth

- Who Is The Wife Of Amrinder Gill A Comprehensive Guide To His Personal Life And Career

- Jason Patric The Underrated Hollywood Star You Need To Know

The History and Evolution of Alipay

Alipay began as a simple escrow service designed to facilitate transactions on Taobao, Alibaba's e-commerce platform. Over the years, it has evolved into a full-fledged digital payment ecosystem, offering a wide range of financial services. This transformation has been driven by continuous innovation and strategic investments in technology and infrastructure.

Milestones in Alipay's Development

- 2004: Launch of Alipay as an escrow service

- 2010: Introduction of mobile payment capabilities

- 2015: Expansion into international markets

- 2020: Launch of Alipay+

Each of these milestones has played a crucial role in shaping Alipay into the global payment leader it is today. By staying ahead of technological advancements and consumer needs, Alipay continues to lead the charge in digital payments.

Key Features of Alipay Cross-Border Payments

Alipay's cross-border payment system offers several features that make it an attractive option for businesses and consumers alike. These features include:

Real-Time Currency Conversion

Alipay's advanced currency conversion engine ensures that transactions are processed quickly and accurately, regardless of the currency involved. This feature is particularly beneficial for businesses operating in multiple countries, as it eliminates the need for manual currency exchanges.

Multi-Currency Support

With support for over 27 currencies, Alipay makes it easy for businesses to accept payments from customers around the world. This broad currency support helps businesses expand their reach and tap into new markets without worrying about payment limitations.

Benefits of Using Alipay for Cross-Border Transactions

There are numerous benefits to using Alipay for cross-border payments, including:

Enhanced Security

Alipay employs state-of-the-art security measures to protect user data and prevent fraud. These measures include biometric authentication, encryption, and real-time risk monitoring, ensuring that transactions are secure and reliable.

Improved Customer Experience

By providing a seamless payment experience, Alipay helps businesses improve customer satisfaction and loyalty. The platform's user-friendly interface and robust features make it easy for customers to complete transactions quickly and efficiently.

Challenges in Cross-Border Payments

Despite the many advantages of Alipay's cross-border payment system, there are still challenges that businesses may face. These challenges include:

Regulatory Compliance

Operating in multiple jurisdictions requires businesses to comply with various regulations and standards. Alipay helps businesses navigate these complexities by ensuring that its platform adheres to the highest standards of compliance.

Transaction Fees

While Alipay strives to keep transaction fees low, businesses may still encounter costs associated with cross-border payments. Understanding these fees and how they impact profitability is essential for businesses looking to maximize their returns.

Statistical Insights into Alipay's Global Impact

Alipay's impact on global payments is significant, with the platform processing billions of transactions annually. According to recent statistics:

- Alipay processes over $1 trillion in transactions annually

- More than 20 million merchants worldwide accept Alipay payments

- Alipay serves over 1.2 billion active users globally

These numbers underscore Alipay's importance in the global payment landscape and highlight its potential for continued growth.

Security Measures in Alipay Cross-Border Payments

Security is a top priority for Alipay, and the platform employs several measures to ensure that transactions are safe and secure. These measures include:

Encryption and Data Protection

Alipay uses advanced encryption techniques to protect user data and prevent unauthorized access. This ensures that sensitive information remains secure throughout the transaction process.

Biometric Authentication

By incorporating biometric authentication, Alipay provides an additional layer of security for users. This feature allows users to verify their identity using fingerprint or facial recognition, reducing the risk of fraud and unauthorized access.

Strategic Partnerships and Collaborations

Alipay's success in cross-border payments is largely due to its strategic partnerships with financial institutions, technology companies, and local payment providers. These collaborations help Alipay expand its reach and enhance its capabilities. Some of the key partnerships include:

Collaborations with Banks and Financial Institutions

Alipay works closely with banks and financial institutions worldwide to ensure seamless integration with local payment systems. This collaboration helps businesses and consumers access Alipay's services more easily and efficiently.

Technology Partnerships

By partnering with leading technology companies, Alipay continues to innovate and improve its platform. These partnerships enable Alipay to offer cutting-edge features and services that meet the evolving needs of its users.

The Future of Alipay in Global Payments

As global commerce continues to grow, Alipay is well-positioned to play a significant role in shaping the future of cross-border payments. With ongoing investments in technology and infrastructure, Alipay is poised to lead the charge in digital payments innovation.

Emerging Trends in Digital Payments

Some of the key trends that will influence Alipay's future include:

- Increased adoption of mobile payments

- Expansion into new markets and regions

- Integration with emerging technologies such as blockchain and AI

By staying ahead of these trends, Alipay can continue to provide world-class payment solutions that meet the needs of businesses and consumers worldwide.

Conclusion and Call to Action

Alipay's cross-border payment system has revolutionized the way businesses and consumers engage in international transactions. With its robust features, enhanced security, and strategic partnerships, Alipay offers a comprehensive solution for global payments. As global commerce continues to grow, understanding and leveraging Alipay's capabilities can significantly impact business success.

We encourage readers to explore Alipay's services and consider how they can benefit their businesses. For those looking to expand their reach into international markets, Alipay provides the tools and resources needed to succeed. Share your thoughts and experiences with Alipay in the comments below, and don't forget to check out our other articles on global payments and digital commerce.

- The Legendary Legacy Of The Dukes Of Hazzard General Lee

- Ben Affleck How Tall

- The End Film Burt Reynolds A Journey Through His Final Cinematic Legacy

- Diy Boat Captain Costume Create Your Own Nautical Look

- The Iconic Harley Emblem A Symbol Of Freedom Heritage And Style

跨境支付、換匯平台 支付寶/微信/人民幣/港幣/台幣/代付/代收/換匯/代購/轉運/貨幣兌換 Hong Kong Hong Kong

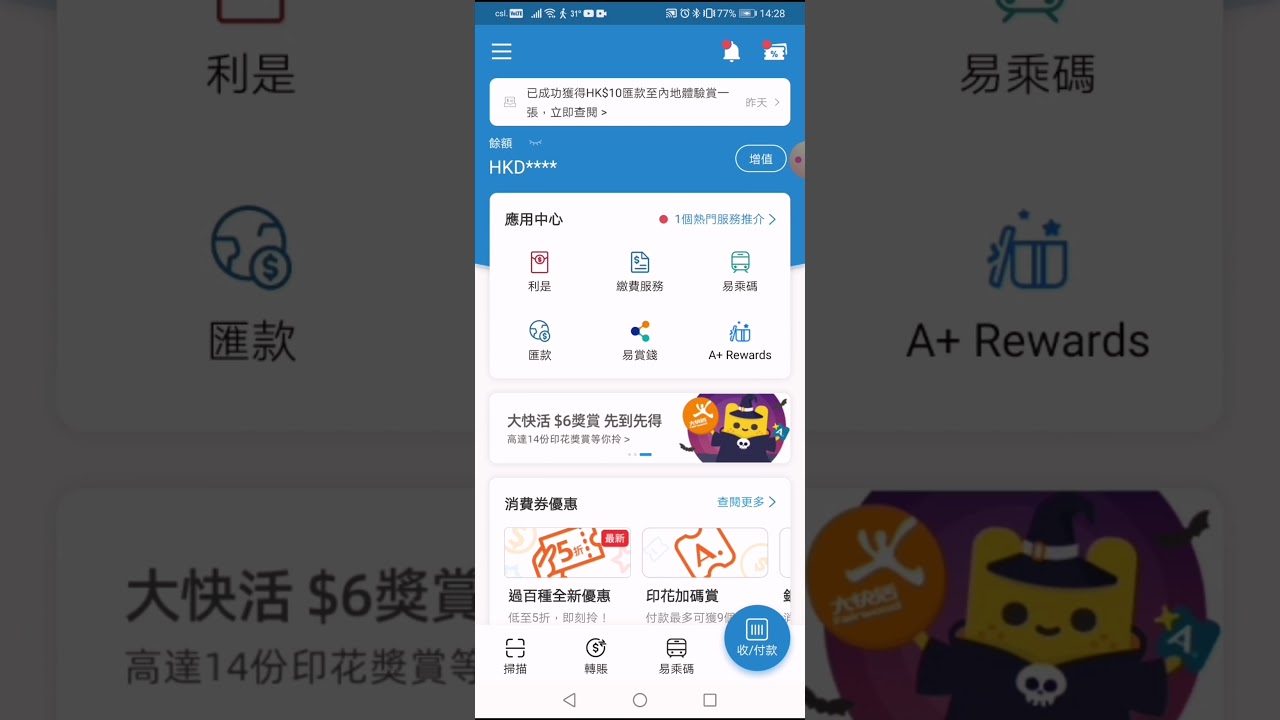

香港支付寶匯款到國內銀行戶口 YouTube

北上消費 內地支付寶開通攻略 無需內地銀行卡也可開通丨跨境匯款&支付 最詳盡講解流程 消費優惠著數多丨支付寶額度限制有哪些丨跨境支付跨境