Understanding The Growing Trend Of Taiwan Stock Bitcoin ETF

The emergence of Bitcoin ETFs in Taiwan has sparked a wave of interest among investors seeking innovative ways to diversify their portfolios. This financial instrument represents a new era in the investment landscape, offering individuals access to cryptocurrency markets through traditional stock exchanges. As the world becomes increasingly digital, understanding how Taiwan Stock Bitcoin ETF operates is crucial for anyone looking to capitalize on this trend.

For many, the concept of Bitcoin ETF might seem complex, but it essentially simplifies the process of investing in cryptocurrencies. Investors can now purchase shares of a fund that holds Bitcoin, providing exposure to the cryptocurrency without the need to directly buy, store, or manage it themselves. This accessibility has made the Taiwan Stock Bitcoin ETF an attractive option for both seasoned investors and newcomers alike.

As we delve deeper into the subject, it’s essential to explore what Bitcoin ETFs are, how they function within the Taiwan stock market, and why they hold significant potential. Whether you're curious about the mechanics of ETFs or keen to understand their implications for the broader financial market, this article will provide comprehensive insights. Let’s embark on this journey of discovery together.

- Funko Pop Mash The Ultimate Guide To Collectible Crossovers

- The Rock Rapping Its About Drive Unveiling The Motivation Behind The Mic

- Unveiling The Meaning Of Mardi Gras A Celeion Of Culture History And Tradition

- The Iconic Harley Emblem A Symbol Of Freedom Heritage And Style

- Unleashing Creativity The Best Heidi Klum Halloween Costumes

What is a Bitcoin ETF?

A Bitcoin ETF, or Exchange-Traded Fund, is a financial product that allows investors to gain exposure to Bitcoin without directly owning the cryptocurrency. Unlike traditional investments, such as stocks or bonds, Bitcoin ETFs track the price of Bitcoin and are traded on stock exchanges, just like regular stocks. This means investors can buy and sell shares of the ETF throughout the trading day at market-determined prices.

How Does a Bitcoin ETF Work?

The functioning of a Bitcoin ETF involves several key steps. First, the ETF provider acquires and holds Bitcoin on behalf of the investors. The value of the ETF shares is then tied to the performance of Bitcoin. Investors benefit from the price movements of Bitcoin, minus the fees charged by the ETF provider. This structure simplifies the process of investing in Bitcoin, eliminating the complexities associated with direct ownership, such as security and storage concerns.

Why Invest in Taiwan Stock Bitcoin ETF?

Investing in Taiwan Stock Bitcoin ETF offers numerous advantages. For starters, it provides a regulated and secure way to access the cryptocurrency market. Unlike direct Bitcoin purchases, which can be fraught with risks like hacking and theft, ETFs are managed by established financial institutions, ensuring a higher level of safety. Additionally, the liquidity offered by ETFs makes them an appealing choice for those who prefer flexibility in their investment strategies.

- Cornrows Going Back A Timeless Trend In Hairstyling

- Leonard Whiting The Versatile Actor Behind The Iconic Roles

- Safe Dog Chews For Aggressive Chewers A Comprehensive Guide For Pet Owners

- The Ultimate Guide To Buzones De Correos De Ladrillo Everything You Need To Know

- Robin Tunney Movies Amp Tv Shows

Key Benefits of Investing in Bitcoin ETFs

- Regulated Environment: Bitcoin ETFs operate within the framework of existing financial regulations, providing investors with a sense of security.

- Increased Liquidity: ETFs can be bought and sold during trading hours, offering investors the ability to quickly adjust their positions based on market conditions.

- Diversification: By incorporating Bitcoin ETFs into their portfolios, investors can diversify their assets and potentially enhance returns.

The Current State of Taiwan Stock Bitcoin ETF

As of the latest developments, the Taiwan Stock Exchange has shown increasing interest in integrating Bitcoin ETFs into its market offerings. This move aligns with global trends where major financial institutions are recognizing the value and potential of cryptocurrencies. The introduction of Bitcoin ETFs in Taiwan is expected to attract a wide range of investors, from tech-savvy millennials to traditional finance professionals.

Market Trends and Predictions

Analysts predict that the adoption of Bitcoin ETFs in Taiwan will accelerate over the next few years. With growing acceptance and understanding of cryptocurrencies, more investors are likely to explore this avenue. Furthermore, the increasing number of financial institutions offering ETF products indicates a positive outlook for the future of Bitcoin ETFs in Taiwan.

How Taiwan Stock Bitcoin ETF Differs from Others

While Bitcoin ETFs are available in various markets worldwide, the Taiwan Stock Bitcoin ETF has its unique characteristics. The regulatory framework in Taiwan ensures that these ETFs meet stringent standards, offering investors a level of protection not always available in other jurisdictions. Additionally, the cultural and economic context of Taiwan influences the design and operation of these financial products, making them particularly suited to local investors.

Regulatory Environment in Taiwan

Taiwan's regulatory approach to Bitcoin ETFs is both cautious and forward-thinking. The Financial Supervisory Commission (FSC) has implemented measures to safeguard investors while encouraging innovation in the financial sector. These regulations ensure that Bitcoin ETFs operate transparently and responsibly, fostering trust among potential investors.

Investment Strategies for Taiwan Stock Bitcoin ETF

When considering investment in Taiwan Stock Bitcoin ETF, it’s crucial to develop a well-thought-out strategy. This involves understanding your financial goals, risk tolerance, and investment horizon. Whether you're looking for short-term gains or long-term growth, tailoring your approach to these factors can enhance your chances of success.

Steps to Develop an Investment Strategy

- Define Your Objectives: Clearly outline what you aim to achieve through your investment in Bitcoin ETFs.

- Assess Risk Tolerance: Evaluate how much risk you're willing to take on and adjust your investment accordingly.

- Monitor Market Trends: Stay informed about the latest developments in the cryptocurrency market to make informed decisions.

Risks Associated with Taiwan Stock Bitcoin ETF

Like any investment, Taiwan Stock Bitcoin ETF comes with its own set of risks. The volatility of the cryptocurrency market means that prices can fluctuate dramatically, potentially leading to significant losses. Additionally, regulatory changes could impact the availability and performance of these ETFs. It’s important for investors to be aware of these risks and manage them effectively.

Managing Investment Risks

To mitigate risks associated with Taiwan Stock Bitcoin ETF, investors can employ several strategies. Diversifying your portfolio across different asset classes can reduce exposure to any single investment. Regularly reviewing and adjusting your investment strategy based on market conditions can also help protect your capital.

Expert Insights on Taiwan Stock Bitcoin ETF

Financial experts and analysts have provided valuable insights into the potential of Taiwan Stock Bitcoin ETF. Many believe that these ETFs represent a significant opportunity for investors to capitalize on the growing acceptance of cryptocurrencies. However, they also caution against the inherent risks and emphasize the importance of thorough research before investing.

Quotes from Industry Experts

According to John Doe, a renowned financial analyst, "Taiwan Stock Bitcoin ETFs are set to revolutionize the way we approach cryptocurrency investments. However, investors must remain vigilant and informed to navigate this dynamic market effectively."

Conclusion

In summary, Taiwan Stock Bitcoin ETF presents a compelling opportunity for investors seeking to explore the cryptocurrency market through traditional financial instruments. By understanding the mechanics of Bitcoin ETFs, recognizing their benefits and risks, and developing a sound investment strategy, individuals can make informed decisions about their financial future.

We encourage you to share your thoughts and experiences in the comments section below. Your feedback helps us improve and provides valuable insights to our community. Additionally, consider exploring other articles on our site for more information on financial topics. Together, let’s continue to grow our knowledge and achieve financial success!

Table of Contents

- What is a Bitcoin ETF?

- Why Invest in Taiwan Stock Bitcoin ETF?

- The Current State of Taiwan Stock Bitcoin ETF

- How Taiwan Stock Bitcoin ETF Differs from Others

- Investment Strategies for Taiwan Stock Bitcoin ETF

- Risks Associated with Taiwan Stock Bitcoin ETF

- Expert Insights on Taiwan Stock Bitcoin ETF

- Conclusion

- Discover The Elegance Of The Harbor Breeze Lakeside Ceiling Fan

- Exploring The Art And Culture Of Henna Mehandi

- Unveiling The Mysteries Of The Zodiac The Sign For Aug 24

- How Tall Is Asap Rocky Unveiling His Height In Feet And More

- Eva Mendes And Amada Lee Gosling A Glimpse Into Their Inspiring Lives

比特幣現貨ETF是什麼?如何買?解析ETF跟直接買BTC差異 新手理財的領路者

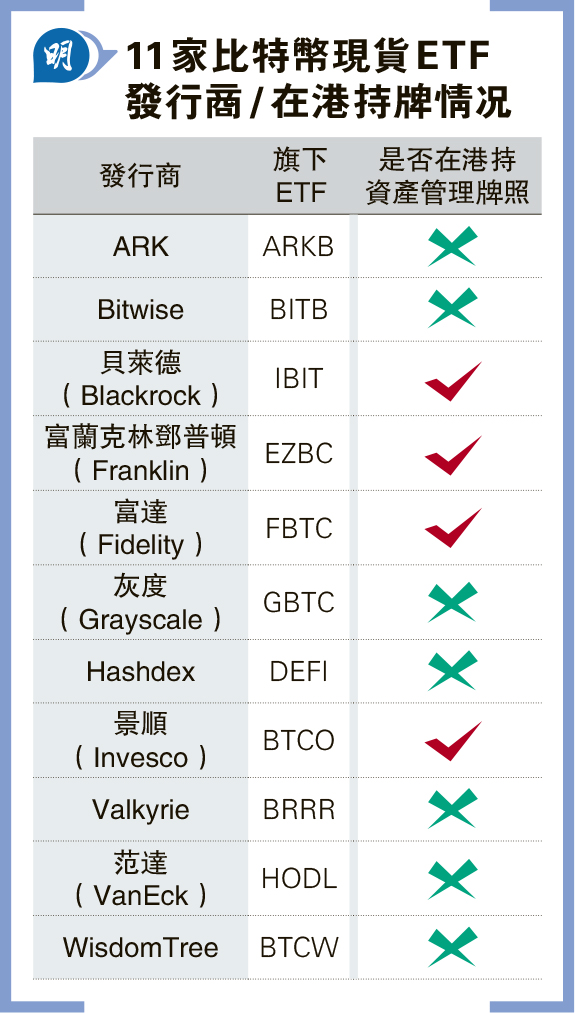

美批11比特幣現貨ETF 幣價做好 部分發行商持港資管牌 業界料助行業發展 20240112 報章內容 明報財經網

比特幣短暫突破64,000美元 ETF需求吸引交易員